In this article, we aim to distill our research on the state of derivative products in the cryptocurrency space and present our thesis on the need for a new kind of decentralized derivatives exchange.

Contents of this paper can be split into 6 major sections —

- Centralized vs. Decentralized Derivatives

- DeFi derivatives

- User Composition

- Volume Composition

- Why are DeFi derivatives lagging?

- How can DeFi derivatives win?

Centralized vs. Decentralized Derivatives

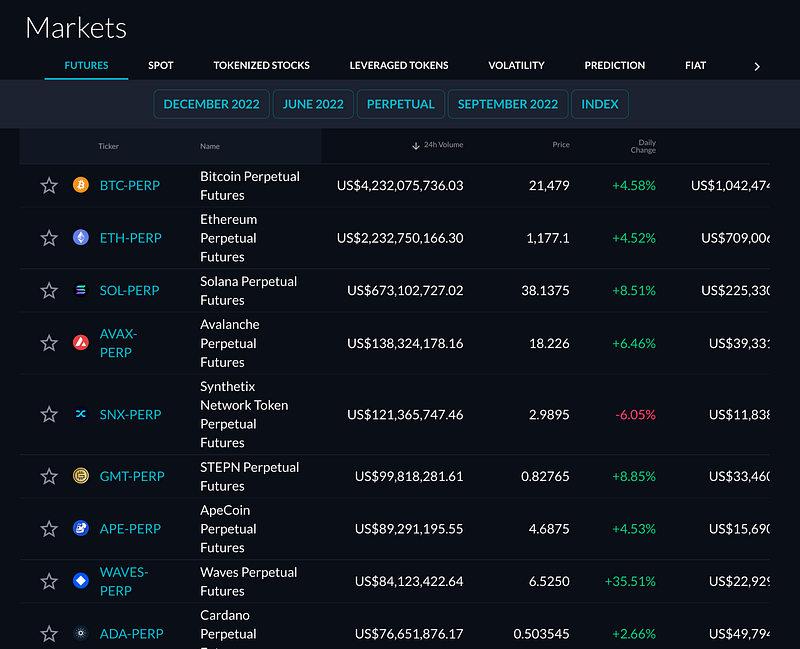

Currently, Centralized exchanges(CeXs) like Binance, FTX, OkEx, Deribit, Delta exchange, Bybit, etc. dominate the market for crypto derivatives.

Let’s now look at some usage stats below —

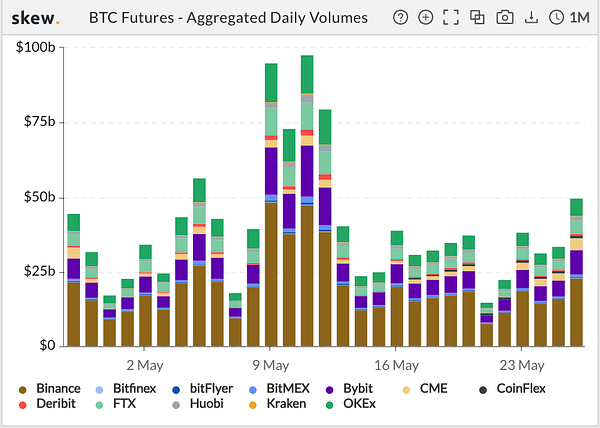

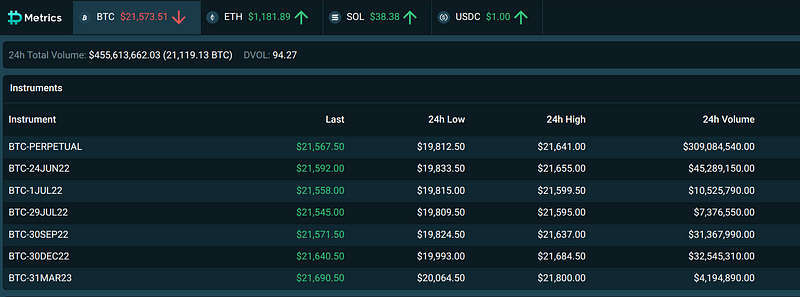

BTC & ETH Futures

ETH & BTC Futures Daily Volumes as of May 27, 2022 (source: https://analytics.skew.com/)

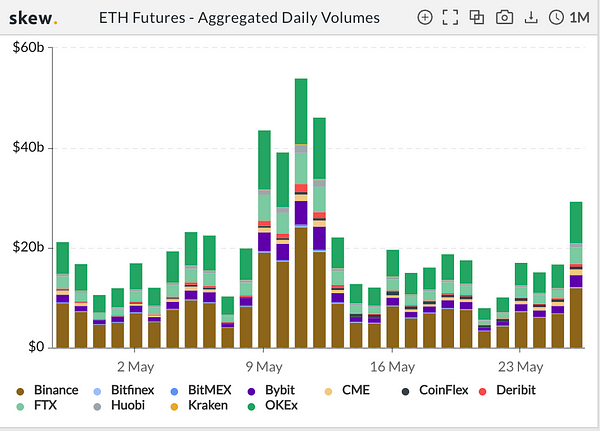

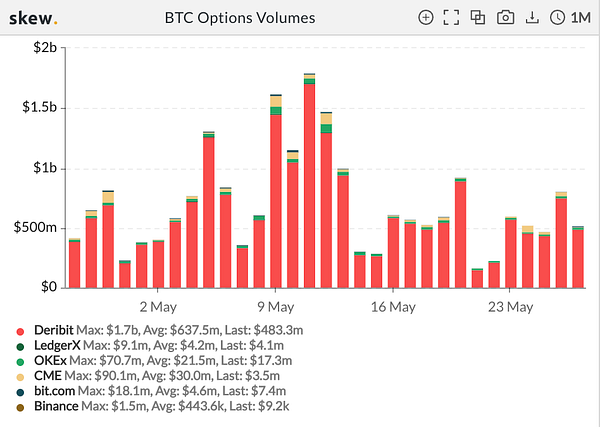

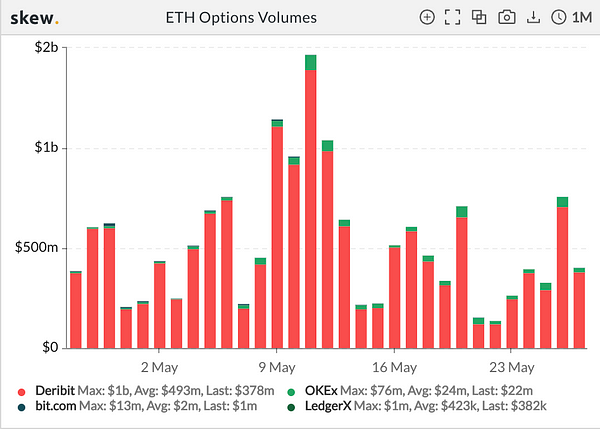

BTC & ETH Options

BTC & ETH Option Volumes as of May 27, 2022 (source: https://analytics.skew.com/dashboard/ether-options)

DeFi derivatives

Let’s now look at usage stats from some of the leading decentralized derivatives protocols to compare, namely dYdX, GMX, Perpetual protocol (Perpetual Futures) & Opyn(European Options)

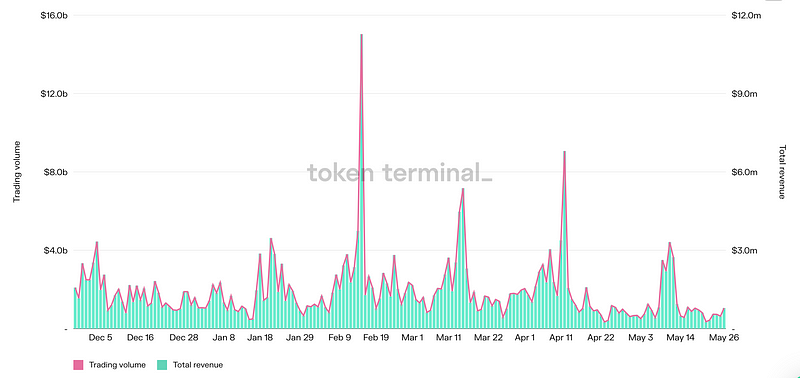

dYdX

A point of note about dYdX is that it uses a hybrid model i.e. a mix of decentralized + centralized(CLOB + matching engine), with the centralized components having a potential long term path towards complete decentralization.

Update: dYdX has recently decided to move to their own Cosmos chain and move away from StarkEX model. The team believes that this is going to enable them to build the best product for their customers.

dYdX Trading Volume & Total-Revenue(source: tokenterminal)

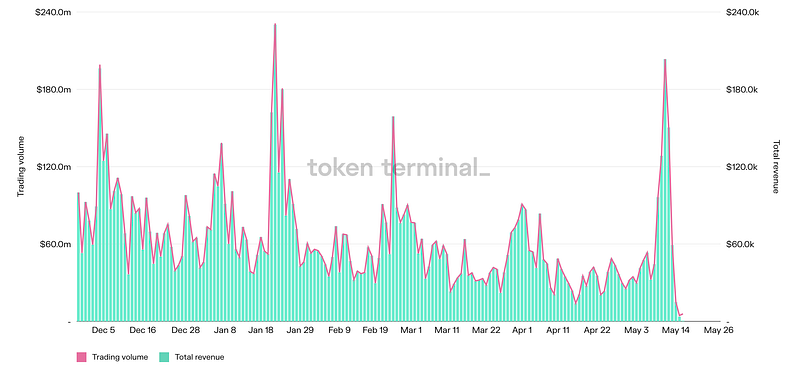

Perpetual Protocol

Perpetual Protocol Trading Volume & Total Revenue(source: tokenterminal)

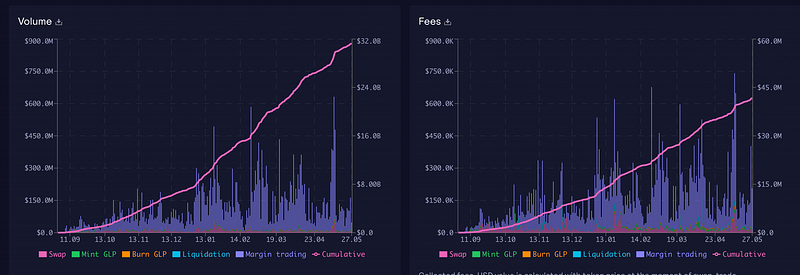

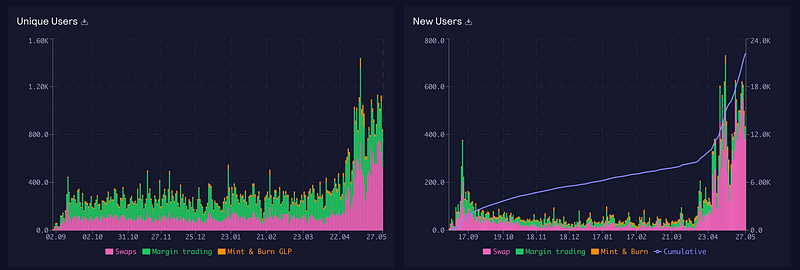

GMX

GMX Volume + Fees (Arbitrum only)

GMX Unique users + New users (Arbitrum only)

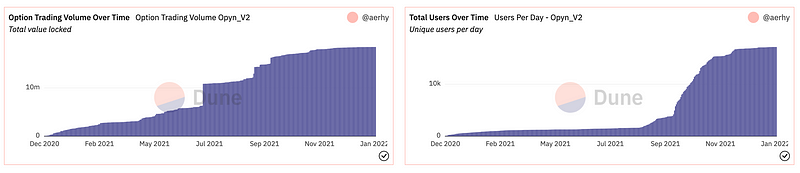

Opyn-v2

Opyn v2 Stats (source: dune.com/aerhy/options-market-overview)

DOVs/Structured Products

Structured Derivatives Protocol

After looking at these stats and numbers, without saying anything about the backend design of these products, we can easily make the following observations —

- Centralized Derivative exchanges beat their DeFi counterparts by a wide margin — in terms of users, volume, liquidity, basically everything!!

- Teams in the DeFi space are segmented by financial construction —

We also analyzed usage stats from major derivative protocols from the Solana ecosystem, including Mango Markets, Zeta markets, PsyOptions, Drift Protocol, and 01 exchange. While being different in the way they’re designed and operate, the above observations remain true for them as well

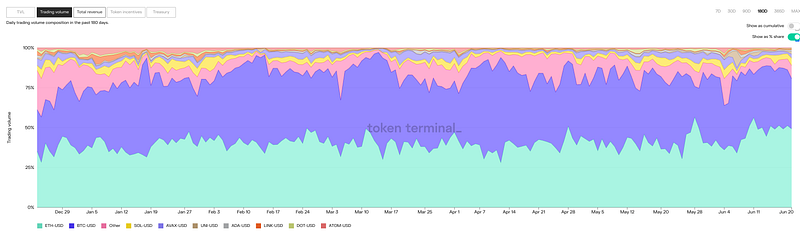

Volume Composition

Trading volume for cryptocurrency derivatives is relatively easier to break down. BTC and ETH dominate the volumes, as seen on both CeXs and DeXs. These two markets consequently are the main contributors to an exchange’s revenue model as well for the same reason.

dYdX volume composition

Perpetual swap mkts vol. on okX(left) + FTX(right)

Perp volumes + mkts available on Delta exchange

ETH, BTC, & SOL = top mkts by vol. on Deribit

Volume for crypto derivatives roughly follows the same pattern across all exchanges. This fact ties in to another pattern where you’ll see newer exchange platform launching with only one market, usually BTC or ETH. For e.g. GMX only had an ETH market when it launched. Even if there’s user demand, Liquidity provisioning can be a huge bottleneck in terms of how many new markets a platform supports. This changes quickly as protocols try to expand to multiple markets without fragmenting liquidity for existing markets/pairs in order to remain competitive with other players in the ecosystem.

User Composition

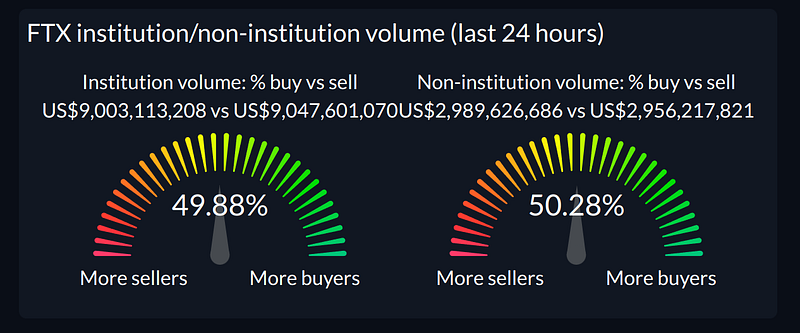

FTX exchange stats — ftx.com/exchange-stats

Institutional mkt share for Options on Deribit — paradigm.co/stats

Some hard truths when it comes to user & volume composition

It’s hard for people to gauge how much of an exchange’s volume is real vs fake. A research report by FTX & Alameda puts the number at ~ 24%. This is usually no easy way to estimate this for a given platform. The methodology for conducting this research is out of the scope of this paper but we recommend the following references for conducting analysis on DeFi derivative deXs (source: rage trade team) —

- Perpetual Protocol v1 — medium.com/@ragetrade/the-perpetual-pvp-ponzi-beaff4a0c662

- Perpetual Protocol v2 — twitter.com/crypto_noodles/status/ + dune.com/ragetrade/PerpV2-Analysis

- dYdX — twitter.com/crypto_noodles/status/

- GMX — github.com/RageTrade/gmx-analysis + twitter.com/crypto_noodles/status/

Why are DeFi derivatives lagging?

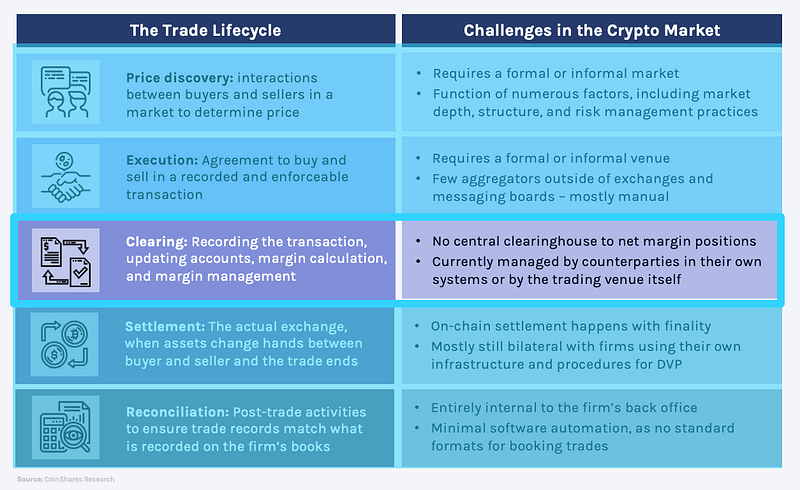

Source: Meltem Demirors via Coinshares

Segmenting by Financial construction is a bad idea ~ kills capital efficiency

- Effectively ensure a lack of composability amongst DeFi derivative protocols, in stark contrast with the rest of the DeFi ecosystem like money markets, AMMs, liquid staking protocols, etc.

- Means no cross-margining & therefore loss of capital-efficiency

- Impossible to delta-hedge — segmented DeFi protocols means one protocol is oblivious of a trader’s positions with other protocols.

- Market makers need to use multiple protocols or even centralized alternatives to hedge their trades, thereby making it harder for them to add liquidity to the exchange.

- No Composability means impossible to implement stuff like Atlantic options (see dopex papers)

DeFi derivatives have no/worse cross-margining

- The most important feature of a derivatives exchange is its margining system & risk engine. These collectively dictate the capital efficiency of trading on the exchange.

- Capital efficiency is crucial because a highly capital-efficient exchange will allow market makers to add deeper liquidity with lower capital requirements.

- It’s hard & extremely inefficient to open delta-neutral or delta-one positions in the first place and impossible to have them work together to achieve reduced margin requirements

Lack of multi-collateral support

Most DeFi derivative protocols only support USDC as collateral. Though this is slowly changing with Perpetual protocol and GMX adding support for more assets. In comparison, FTX supports multiple assets to be supplied as collateral with each contributing differently to its margining system.

Collateral weights — help.ftx.com/hc/en-us/articles/360031149632-Non-USD-Collateral

Allowing multiple assets to be used as collateral in a derivatives exchange is important primarily because it unlocks liquidity for trading without sacrificing direct exposure to the collateral asset. This feature can even enable other protocols to build delta-neutral basis-trading mechanisms like UXD Protocol on Mango Markets

No margin and/or cross-collateral support

To reduce risk, DeFi option protocols require option writers to post maximum loss as collateral. This is extremely inefficient when compared to TradFi or centralized crypto exchanges.

Although Opyn v2’s gamma protocol added support for undercollateralized options powered by early liquidations and their very own margin calculation system, no one seems to be using it in production. This is probably because DeFi option protocols have found their Product-market-fit with DOVs or Structured product protocols like Ribbon, Friktion, Thetanuts, etc. Undercollateralized options being used in DOVs make such DOVs even riskier as these currently don’t utilize any mechanisms to hedge their tail risk.

Lack of a scalable settlement layer for DeFi Options & DOVs(DeFi Option Vaults)

DeFi options(crypto options in general) have struggled to gain traction and currently lag behind as compared to Option volumes in TradFi. As the founder of a leading options exchange told us — no one wants to buy options in the crypto space, yet!!

According to our research, the issues in the DeFi options and DOVs(DeFi Option Vaults) landscape are as follows —

Lack of liquidity ~ Low capital efficiency + Fragmentation + Hard-to-use

Crypto Options Market ~ Quote-driven vs. Order driven

- Lack of ideal infrastructure for fast settlement of options → Lack of liquidity

- No liquidity for options → Options are sold via Gnosis Auction or via naive OTC desks (Airswap OTC).

- No market for buying options → only option selling strategies are possible

- Crypto options market is more Quote-driven as opposed to Order-driven whereas settlement in DeFi options is fragmented into a mix of Gnosis auctions, LP pools, Airswap OTC etc. Although as a sign of convergence most DeFi Option Vault(DOV) providers(Ribbon, StakeDAO, Thetanuts, Friktion) have partnered with Paradigm to include their RFQ system within their respective settlement processes.

- Lack of interoperability b/w multiple option protocols on diff chains → DOVs restricted to options protocols on one chain. This means options liquidity is fragmented between multiple chains and it’s hard to unify via existing infra i.e. bridges. This issue also exists with multi-chain perpetual exchanges like GMX where liquidity and users are fragmented by chain.

- Options are still not used for hedging stuff in DeFi like LP positions, hedging of options exposure(for Market makers), perpetual futures.

- LPs in the Option protocols & DOVs (the decentralized market-making pools like Hegic, option AMMs, etc) aren’t hedged in a way a true market maker would be. This is a hard problem to solve, especially on-chain.

- All structured product / DOVs running option selling strategies usually sell to the same small group of market makers. Initially, market makers bought these options to hedge their existing positions elsewhere but now these market makers have been hedging this bought option exposure(a portion) by writing the same options contracts on centralized exchanges like Deribit & Delta exchange. Even allowing for open auctions via Gnosis auctions hasn’t made much difference yet as no one apart from market makers is interested in buying them. Another data point to account for is the short-term dampening of premiums observed every week when these DOVs roll over every Friday. All these things suggest that there is not enough organic demand for these options and growth in the TVL of such structured products/DOVs will lead to further dampening of premiums which might consequently disincentivize retail demand.

- Most decentralized exchanges have a much slower UX as compared to CeXs and none offer mobile-based clients(except dYdX on iOS). The ease of use factor is certainly a huge issue when it comes to DeFi in general.

Pool-Based vs Order-book based mechanics

DeFi protocols mostly rely on pool-based models due to a lack of scalable order book models and corresponding throughput challenges. dYdX is an exception as it utilizes a custom-built CLOB(Centralized Limit Order Book) and matching engine, in the form of StarkEx. This centralized component which allows scalable throughput gives dYdX a leg up against all its fully decentralized competitors. In contrast, GMX which uses a pool-based model has been growing in terms of users and volume.

Risk Engines, Liquidations & preventing clawbacks

- Risk engines for derivatives are hard to build on-chain because of their intense computation requirements as well as their need to access real-time data feeds. These are both big bottlenecks in today’s crypto environment.

- Getting an accurate mark price for options is a big problem — For e.g. how Deribit calculates an option’s mark price is not possible to replicate on-chain therefore most DeFi protocols use Black-Scholes for doing this

- Liquidation mechanisms in DeFi differ very much from those used in CeFi and are a big contributor to their bad capital efficiency. CeFi exchanges are able to identify a liquidatable position, issue a margin call & subsequently gradually liquidate it, all in a matter of minutes. This is different from DeFi liquidations which utilize auctions, third-party liquidators, and triggering mechanisms. These also suffer from MeV as well as have to account for network congestion, things that CeFi exchanges don’t have to worry about.

- Due to the highly volatile nature of cryptocurrencies, preventing clawbacks is one of the most important goals of an exchange’s risk management system. A poorly designed risk management system can & does lead to large clawbacks like that of OkEx & more recently the Solend incident. Another caveat is that centralized exchanges can more easily iterate on their risk engine as opposed to risk engines implemented as a system of smart contracts which can be hard to upgrade/update.

Some important metrics for reference -

- dYdX processes orders at a speed of 1000 orders place/sec and with actual blockchain trades taking place at a speed of 10–30 trades per second

- Solana derivative exchanges can leverage its 60k+ tps with ~ 400ms block times but have frequent network halts due to validators going out of sync. Furthermore, it can be hours before the network gets in sync again & restarts. This can be a death blow for a derivatives exchange. (Also sometimes -> Solana network is experiencing degraded performance. Transactions may fail to send or confirm. (TPS: 1238))

- There have been instances where the sequencers of major L2s have also halted tx submissions causing network halts — Arbitrum One Beta

- Chainlink price feeds only update post every 0.5% movement on mainnet & every 0.05% movement on Arbitrum, every 0.1% on Avax, FTM & BSC

How can DeFi derivatives win?

- Composable derivatives or exert full-stack control

To enable true cross-margining, different financial derivatives need to interface together efficiently. Take options as an example; for Options to really shine, they need to interface with perpetual swaps.

Derivatives should integrate with existing DeFi protocols for hedging & leverage seamlessly. Currently, this is not possible due to protocol mechanic limitations. It’s not possible to get Opyn’s oTokens to compose with perpetual swaps on dYdX. This level of composability needs to be pre-planned with functionality built into the codebase itself.

The other, more easier way, is to have a single protocol which exerts full control and offers a full-stack of derivative products.

- Hedging LP positions

- Hedging lending positions

- Increased leverage i.e. the main reason why options became popular among retail stock traders

2. Cross-margin everything

Users on DeFi derivative platforms frequently use other external platforms to hedge their positions. This can be due to the lack of markets, derivative instrument support or plain old lack of liquidity. Users need a single platform for trading multiple derivatives with deep liquidity.

3. Robust Risk Engine ~ upgradable constraints paired w/t Better Liquidation mechanisms

4. Reimagine Infrastructure, i.e. Scalable liquidity and settlement layer

5. Leverage DeFi native instruments

Power perpetuals — Power perps, first introduced by the teams at Opyn and Paradigm, are a new financial derivative native to DeFi. Amongst other things Power perps can be used to hedge concentrated liquidity AMM LP positions, options, and pretty much any function payoff with a combination of a futures and a quadratic hedge.

source: medium.com/opyn/hedging-uniswap-v3-with-squeeth-bcaf1750ea11

- Hedging uni-v3 with Squeeth — medium.com/opyn/hedging-uniswap-v3-with-squeeth-bcaf1750ea11

- Hedging options with Squeeth — medium.com/opyn/how-to-hedge-options-with-squeeth-b5e30d5d83ac

Uniswap v3 LP Positions — it’s possible to build automated hedging strategies using Uniswap v3’s concentrated liquidity LP positions to hedge stuff. It’s theoretically possible to hedge any derivative with a positive gamma using multiple uni-v3 LP positions.

Syndr: Product Thesis

At Syndr, our goal was to reimagine the derivatives space and build everything from the ground up.

At Syndr, we’re building a decentralized cryptocurrency derivatives exchange that offers Options, Perpetuals, and Power perpetuals. We’re the very first DeFi platform to pioneer the trading of multiple derivative products on a single platform with high capital efficiency.

The core technological innovation behind Syndr is using a custom-built stack that leverages a combination of technologies, including ZK Provers, Syndr TEE, scalable offchain orderbook, Smart contracts, and a robust risk management layer

Core features of Syndr Exchange are as follows —

- Single platform for multiple derivative products — namely Options, Perpetuals & Power perpetuals

- Cross Margining

- Multi-Collateral support with cross-collateralization

- Portfolio Margining support

- Reimagined infrastructure for high throughput —Decentralized Settlement powered by an Offchain orderbook

- Robust Risk management

- Full Composability ~ Tokenized Sub-accounts

We’re currently heads down in build mode, and We’re looking forward to sharing more information and updates about our platform in the coming weeks.

Calling all traders, institutions, and market makers, get in touch now for early access!