Options in DeFi have been a graveyard of protocols where no one has been able to gain any significant traction. Currently, no major liquid markets for trading crypto options exist anywhere in the DeFi space. The only product market fit they’ve found is within structured products i.e. DeFi Option Vaults(DOVs). DOVs, although simple to use & understand, are extremely limited and generally inflexible in terms of what they can be used for.

We have been working on this since the start of 2022 and are super bullish on the entire Options space in general. We also earlier wrote an entire product thesis about Syndr, crypto Options, and the wider DeFi derivatives space here —

Syndr Product Thesis: How can DeFi derivatives win?

A deep dive into crypto derivatives! medium.com

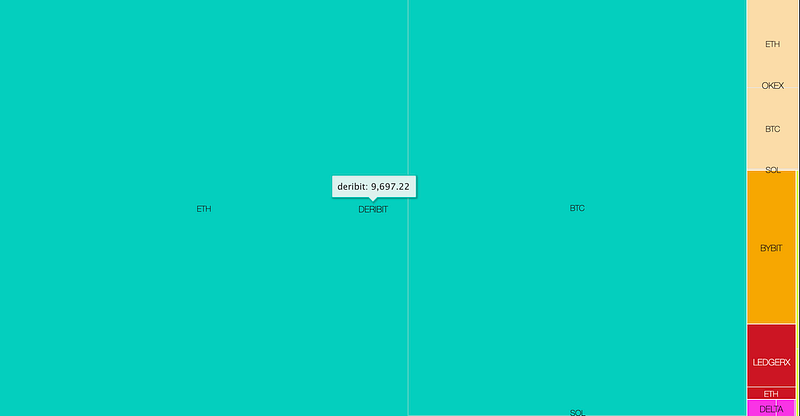

That being said, Options are unique! Unique in the sense that even giant centralized crypto derivative platforms like FTX and Binance have struggled to gain traction in the space. The CeFi market for Options can be summarised very well by the following chart —

CeFi Notional OI $M (source: Genesis Volatility)

Enter Syndr!

What is Syndr?

Syndr is an institutional-grade options and futures exchange.

- Trade Options + Futures with low fees.

- High-performance orderbook: low latency trades

- High throughput: powered by our custom layer3 rollup

- 100+ markets with daily/weekly/monthly/quarterly expiries

- Portfolio/SPAN Margining

- Block-trading integrations

- Easy Onboarding & Simple + familiar UI

What makes Syndr different?

We aim to become the #1 platform for trading options and perps on-chain by hyper-optimizing for capital efficiency and performance.

- Low latency and high throughput — Users can trade on our orderbook with 1–30ms of latency which scales to thousands of orders per second. (unprecedented in the DeFi infra landscape!)

- Capital-efficiency for traders & market-makers — Easy to run delta-hedged strategies with reduced collateral requirements (courtesy of our portfolio/SPAN margining system). As of Sep 2022, no one does portfolio margining in the entire DeFi space.

- Perpetuals + dated futures — Syndr also enables easy hedging of options exposure via perpetuals & dated futures natively on the same platform.

- Block-trading on Syndr — Native support for block-trading platforms and easy integrations through RFQ platforms for institutions. One-click trading for spreads, combo products, etc.

- Multi-collateral support — Syndr will support depositing more than just stablecoins as collateral. Think USDC, USDT, ETH, WBTC, etc.

- Easy onboarding — easy to use, deposit from any chain using Socket.tech

- Low fees — with a plan towards NO FEES!!

- Easy integration w/t API endpoints — We support WebSockets, REST & FIX.

- No dependencies — We’ve built the entire system from scratch with full-stack vertical integration

Easy+Efficient Liquidity Provisioning

It has never been this easy to do market-making and liquidity provisioning as it is on Syndr.

Perpetuals futures are the easiest way to hedge your options exposure. The presence of high-performance perps combined with portfolio margining for both (options + perps), all on the same platform, makes it easy for market makers to hedge their exposure in a capital-efficient manner.

Market maker testimonials incoming )

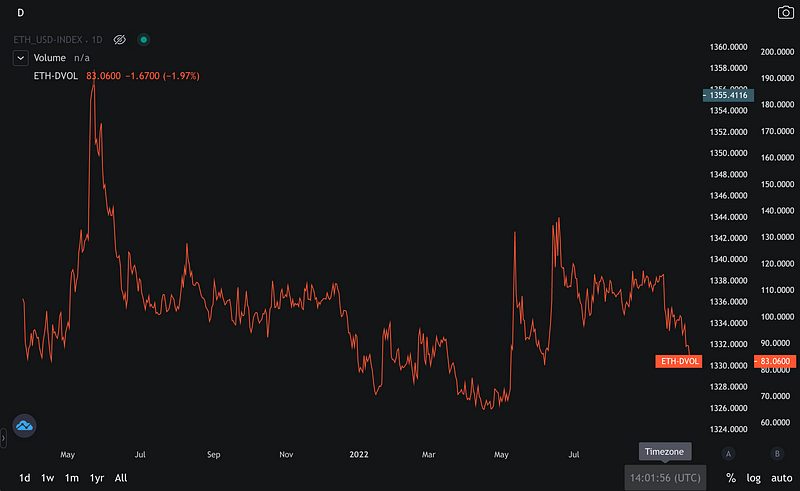

Rising Vol & stability via crypto Options

source: Deribit

Crypto markets are notorious for having higher volatility than traditional markets. Although cryptocurrencies are currently a new and hyper-volatile asset class, we expect them to be no more volatile than other TradFi assets in the coming medium-to-long term future. As the entire crypto finance space matures, we expect options to play a big part in providing stability to the new and existing users in the space.

Right now the current market for crypto options trading is mostly institutional but the retail adoption although slow has been growing. The existing institutional market has also been growing as new, and more established institutions from the traditional finance space enter the market.

This is the reason why we’re bullish on the entire crypto options space in general and also why we’re building Syndr.

Vitalik on sensible layer3 designs

Syndr exchange utilizes a hybrid infrastructure design which ultimately inherits all the security guarantees of the Ethereum mainnet. We combine both on-chain and offchain components to give the user an experience that is the best of both worlds — the user still trades with full custody of their funds, but the platform itself is as powerful and scalable as a centralized exchange(meaning low latency and high throughput). We are powered by a custom layer 3 rollup. We’ll release more details about the platform as we move closer to our public testnet.

Join us

Syndr is an institutional-grade options and futures exchange powered by our very own layer-3 Rollup.

If you’re interested in joining our team, write to us at [email protected] or DM us on Twitter at https://twitter.com/SyndrHQ